Historically, the fourth quarter is the bitcoin's best; this year it's underperforming.

What to know:

- Historically, the fourth quarter has been the most bullish for bitcoin, with prices up by an average of 85% since 2013.

- The last week of the year tends to see at least a 3% gain on average, but the past five out of six years have seen a decline.

- The current short-term holder's realized price (STH RP) is $84,000, suggesting the bull market is still intact as long as bitcoin stays above this key level.

As 2024 draws to a close, bitcoin (BTC) is underperforming, counter to its historical performance in a year-end "Santa rally."

The largest cryptocurrency generally adds about 2.8% in the 51st week, this week it's on course to slide 11%. And, while it's tended to gain 3% in week 52, in five of the past six years the BTC price has dropped. So there's not much hope this time around either.

Story continues belowDon't miss another story.Subscribe to the Crypto for Advisors Newsletter today.See all newslettersBy signing up, you will receive emails about CoinDesk products and you agree to our terms of use and privacy policy.

The exact timing for what's considered a Santa rally varies, but it's clearly as December nears January and perhaps a few days either side.

The trend extends to the whole quarter too. The fourth quarter tends to be one of bitcoin's strongest, but this year it's underperforming. Since 2013, the BTC price has risen an average of 85% in the last three months of the year, Coinglass data show. In 2024, it's less than 50%.

This current drawdown is reminiscent of the start of 2021, admittedly a bit later than Santa would be popping down the chimney.

On Jan. 8, 2021, bitcoin was around $40,000. By Jan. 27, the price had dropped to $30,000, a 25% slide and somewhat larger than this current 15% drawdown.

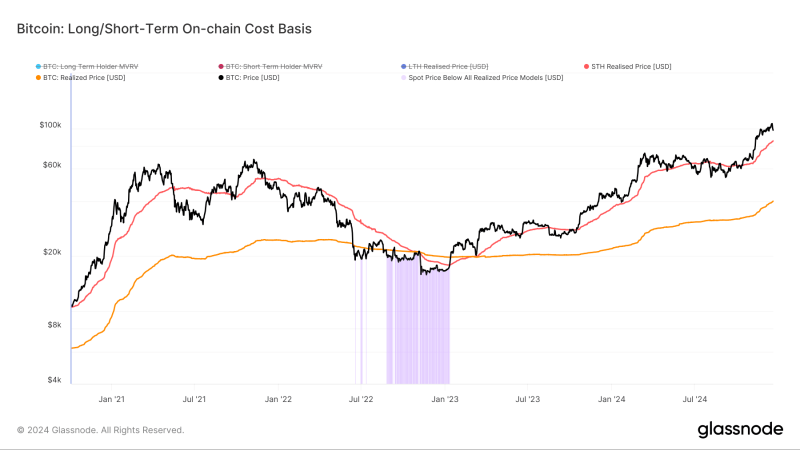

However, that drawdown was in the middle of a bull run that started from around $10,000 in December 2020 and ended in November 2021 at $70,000. The similarities are that the realized price, the average on-chain cost for all tokens in circulation, continues to drive higher, meaning investors, on average, are buying coins at higher prices.

Meanwhile, the price stays ahead of the short-term holder's realized price, reflecting the average on-chain acquisition price for coins that were moved within the last 155 days.

From December 2020 to April 2021, bitcoin stayed above the short-term holder's realized price (STH RP) and used this level as support; typically, in bull markets, bitcoin uses this price level as support. The current STH RP is $84,000, which would suggest the bull market is still intact as long as bitcoin stays above this key level.