In the rapidly evolving landscape of global finance, the fairly recent emergence of Central Bank Digital Currency (CBDC) represents a significant shift towards the digitalisation of national currencies. The Bangko Sentral ng Pilipinas (BSP), under the leadership of Governor Eli M. Remolona Jr., is poised to position the Philippines ahead in this digital finance revolution.

The potential issuance of a CBDC by the BSP, recently announced by the Governor to be possible as early as next year or by 2026, signals a proactive approach to integrating digital currency into the Philippine financial system, echoing developments in countries such as Sweden and China.

The Rationale Behind the BSP Wholesale CBDC

Eli M. Remolona, Jr

Governor Remolona’s term, which commenced on July 3, 2023, has been characterised by a strategic vision towards incorporating a digital currency within the Philippines’ monetary framework. This vision is partly inspired by the advancements in CBDCs globally, where countries have demonstrated progress and potential benefits.

The BSP’s consideration of issuing its own CBDC sooner than initially anticipated reflects a strategic move to provide a regulated digital currency alternative, aiming to replace unregulated cryptocurrencies with a more secure and regulated option.

Understanding CBDCs in the Philippine Context

CBDCs denote digital money that is pegged to a country’s national currency and represents a direct liability of the central bank. This modern form of currency offers a safer and more regulated alternative to privately-issued cryptocurrencies, potentially enhancing the efficiency and security of financial transactions.

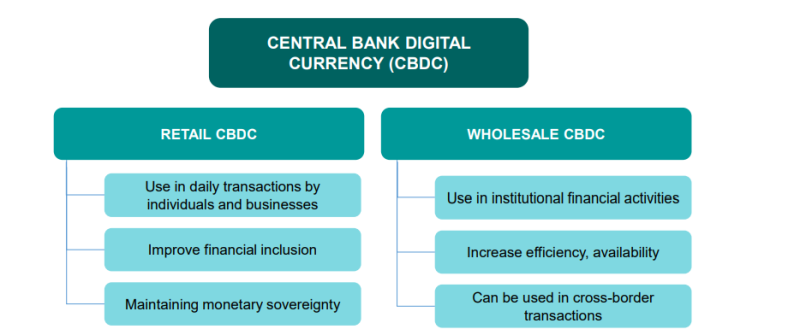

Retail CBDC vs Wholesale CBDC. Source: AMRO staff

The BSP’s preference for a wholesale CBDC — intended for transactions between commercial banks and other financial institutions — underscores a strategic focus on streamlining operations such as interbank payments, securities transactions, and cross-border payments.

Opting for Hyperledger Fabric as the distributed ledger technology (DLT) for the pilot project of the wholesale CBDC reflects the BSP’s dedication to employing advanced technology to fulfil its digital currency objectives.

Project Agila: Spearheading CBDC Implementation

Project Agila represents a significant stride towards the BSP’s ambition of launching a CBDC. Named after the Philippine Eagle, it symbolises the BSP’s high-flying aspirations in the digital currency domain.

Mamerto E. Tangonan

BSP Deputy Governor Mamerto E. Tangonan had told the INDX 3 Summit that the primary motivation behind exploring CBDCs is the potential cost savings in payments and increased efficiency. The Deputy Governor added that another pivotal aspect is the enhancement of payment system safety and resilience.

By using distributed ledger technology, CBDCs eliminate a single point of failure, DG Mamerto said — providing not only a backup system but potentially an alternative to the real-time gross settlement system.

Financial inclusion also stands at the core of CBDC development. By presenting a risk-free instrument backed by the BSP, Project Agila has the potential to counter the rise of privately-issued currencies like stablecoins. Additionally, being digital, CBDCs simplify the process of issuance, distribution, and monitoring, enhancing monetary policy transmission.

The project has two primary phases: the proof of concept and the prototype phase. These steps will help to evaluate the best technology for CBDCs in the Philippines, focusing on controlled access, security, efficiency, availability, interoperability, flexibility, and programmability.

For now, Project Agila encompasses a pilot phase involving several major banks, designed to test the CBDC’s functionality in facilitating fund transfers outside traditional banking hours, employing Hyperledger Fabric DLT. This initiative demonstrates a collective effort towards establishing a more efficient and secure financial system in the Philippines.

Mamerto E. Tangonan, Deputy Governor and head of the Payments and Currency Management Sector (PCMS) of the BSP, presenting why the central bank is studying the wholsale CBDC.

The Global Landscape of CBDC Development

The worldwide momentum towards the development and implementation of CBDCs highlights their potential to revolutionise financial transactions by offering enhanced levels of efficiency, security, and inclusivity. With a significant number of countries, including those with large economies, actively exploring or deploying CBDCs, the BSP’s initiative aligns the Philippines with a global trend towards financial innovation.

The Atlantic Council documented that by December 2023, 130 nations including 35 in the Asian region — accounting for 98% of the worldwide GDP — were investigating the potential of CBDCs. This represents a significant increase from May 2020, when only 35 nations were contemplating the adoption of a CBDC.

The analysis further reveals that 19 G20 nations have progressed to the advanced phases of CBDC exploration, with nine of these countries actively conducting pilot trials.

So far, 11 nations have fully implemented a digital currency. The pilot for China’s digital yuan, reaching an audience of 260 million, undergoes tests across more than 200 applications, including but not limited to public transportation, stimulus disbursements, and online shopping.

The path towards the BSP’s CBDC vision is fortified by collaborative international efforts, particularly with the International Monetary Fund (IMF) to kick off its wholesale CBDC pilot project, called CBDCPh at the time. The IMF’s advisory role in the technical development of the CBDC, coupled with its provision of training support to BSP staff, exemplifies the global financial community’s backing of the Philippines’ digital currency initiative.

Such international collaboration underscores the importance of joint efforts in tackling the complexities associated with the implementation of digital currencies.

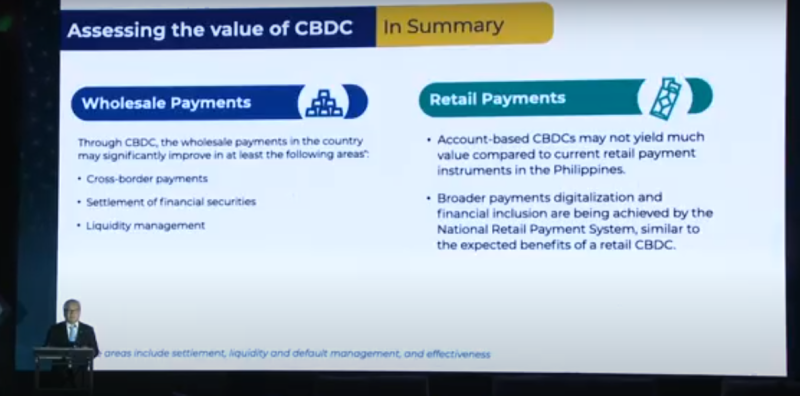

Deputy Governor elaborating why the Philippines is going with wholesale CBDC trials over retail.

The Broad Implications of CBDCs

The BSP’s exploration into a CBDC transcends mere technological innovation; it signifies a strategic endeavour to elevate the safety, efficiency, and inclusivity of the financial system. By centering on a wholesale CBDC for interbank transactions, the BSP aspires to refine the infrastructure for both domestic and cross-border payments.

The ability of CBDCs to combine the characteristics of cash with digital formality simplifies transactions and mirrors the ease people find in cash transactions.

Beyond operational benefits, the anticipated CBDC promises greater financial inclusivity by facilitating broader access to banking services for the unbanked population and bolstering the growth of micro, small, and medium enterprises (MSMEs).

Envisioning a Future with Digital Currency

The BSP’s strategic initiatives towards the development and potential launch of a CBDC within the next few years, or even next year, mark a pivotal moment in the Philippines’ journey towards a digital financial ecosystem.

The focus on a wholesale CBDC, the collaborative nature of Project Agila, and the support from international entities like the IMF, all reflect the BSP’s commitment to fostering financial innovation and inclusivity. As the world gravitates more towards digital currencies, the BSP’s efforts in exploring and implementing a CBDC will likely play a crucial role in sculpting a more efficient, secure, and inclusive financial future for the Philippines.

Featured image credit: Edited from Freepik